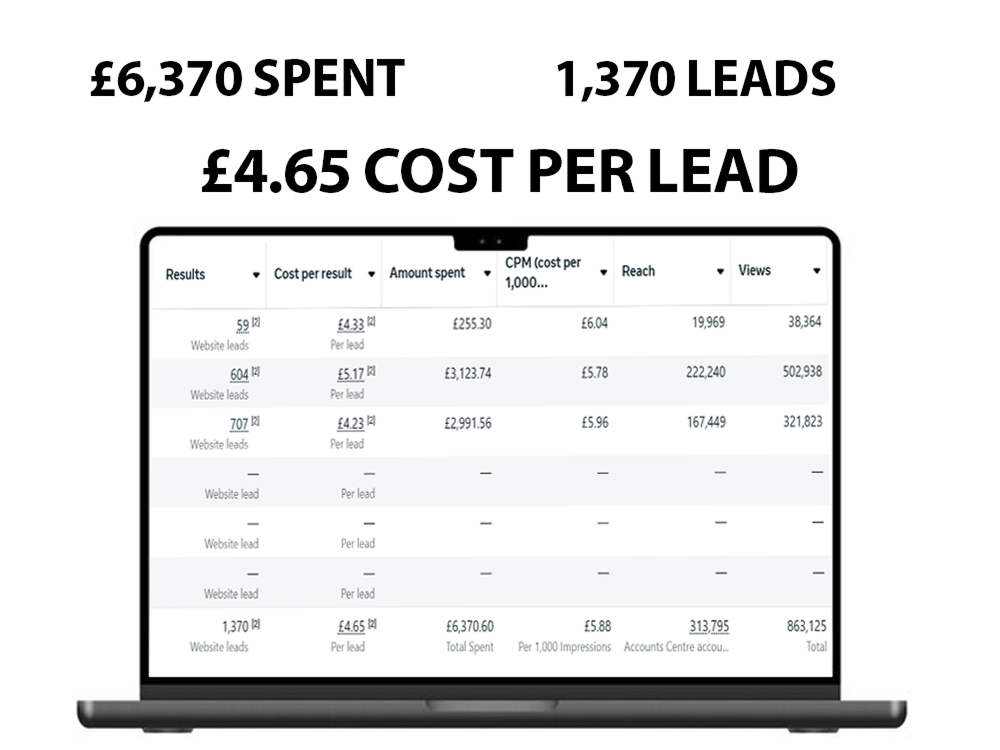

Meta Ads – Insurance Lead Generation at £4.65 CPL

Challenge

The insurance industry is highly competitive and cost-per-lead rates can easily skyrocket if campaigns aren’t structured properly. The client had previously struggled with expensive, low-quality leads that wasted time and resources for the sales team.

The main challenges included:

Generating qualified leads at a profitable cost.

Ensuring leads were automatically added to their CRM for instant sales follow-up.

Filtering out unqualified prospects to avoid wasted ad spend.

Objectives

Achieve profitable lead generation at or below £5 CPL.

Ensure leads are high-quality and sales-ready.

Set up CRM automation for seamless lead management.

Deliver consistent lead volume to fuel the client’s sales pipeline.

Optimize campaigns for long-term scalability.

Strategies

We implemented a 10-step advanced Meta Ads strategy tailored specifically for lead generation in the insurance niche:

Technical Setup & Tracking – Installed and configured Facebook Pixel, Conversions API, and integrated lead forms with the client’s CRM for real-time sync.

Industry Research & Persona Development – Studied customer behavior, age groups, income levels, and motivations for purchasing insurance policies. Built customer avatars to target the right prospects.

Funnel Segmentation (TOFU, MOFU, BOFU) – Designed campaigns for awareness (educating about insurance), interest (highlighting benefits), and action (direct lead forms).

High-Performing Lead Forms – Created instant forms with qualifying questions (e.g., insurance type, budget, timeline) to filter serious prospects only.

Compelling Creatives & Copy – Used trust-driven creatives such as testimonials, security icons, and simple “peace of mind” messaging to overcome skepticism. Crafted ad copy with strong CTAs like “Get Your Free Quote in 60 Seconds.”

Audience Targeting Layers – Combined broad targeting, interest-based targeting (insurance, financial planning, family protection), and lookalike audiences based on existing customer lists.

Retargeting Campaigns – Built retargeting flows for website visitors, form openers who didn’t submit, and engaged users. Offered reminders and urgency-driven CTAs.

Budget Optimization (CBO Approach) – Used Campaign Budget Optimization to let Meta allocate more spend towards top-performing ad sets, ensuring efficiency.

Split Testing & Iteration – Ran A/B tests on creatives, form lengths (short vs. detailed), and CTA variations to identify the highest-converting combinations.

CRM Automation & Follow-Up – Integrated leads directly into the client’s CRM with instant email/SMS notifications to ensure the sales team contacted leads within minutes, dramatically improving conversion rates.

Conclusion

This case study demonstrates the power of Meta Ads in lead generation for high-ticket industries like insurance. By focusing on audience research, optimized lead forms, and CRM automation, we achieved a £4.65 CPL and ensured that 1 in 5 leads converted into paying customers. This system not only delivered results but also gave the client a long-term growth engine for their business.

Solutions & Results

Solutions

Through a data-driven and funnel-based approach, we solved the client’s biggest challenge: generating high-quality insurance leads at scale. By combining compelling creatives, filtered forms, retargeting, and CRM automation, the campaigns consistently produced leads that were both affordable and highly qualified.

Results

Achieved a £4.65 Cost Per Lead across all campaigns.

Maintained a 20% sales conversion rate from leads to paying customers.

Delivered a steady flow of qualified leads into the CRM, ensuring the sales team had new prospects daily.

Provided the client with a profitable and scalable lead generation system.

Do you want to Transform your brand into a future powerhouse? It’s time to kick things off.